FAQ

Menu Lateral Investor Relations

Gestor-FAQ

FAQ

accordeon-faq

- What is Grupo Aval?

- When was Grupo Aval created?

- Where are Grupo Aval offices located?

- Who regulates Grupo Aval?

- How many stockholders does Grupo Aval have?

- Where is the stock traded and what is its ticker?

- What is the difference between Grupo Aval ordinary (common) and preferred shares?

- What is Grupo Aval's credit rating?

- How many employees does Grupo Aval have?

- What is Grupo Aval's network?

From a strictly legal perspective, it is a holding company that owns - directly or indirectly - the majority of the shares in Banco de Bogotá, Banco de Occidente, Banco Popular, Banco AV Villas, Porvenir, Corficolombiana and others in Colombia.

From an operational perspective, Grupo Aval is a company with approximately 124 employees (as of December 31, 2024) dedicated to researching, analyzing, identifying synergies and best financial practices and recommending their implementation in entities controlled by the company.

Grupo Aval was constituted as a corporation in 1994, but it wasn't until 1998 that it changed its company name from Administraciones Bancarias S.A. (ABSA) to Grupo Aval Acciones y Valores S.A. (Grupo Aval).

Our offices are located in Carrera 13 No. 26ª – 47 23rd floor, Banco de Occidente Building, in the city of Bogotá, Colombia.

Grupo Aval Acciones y Valores S.A. (“Grupo Aval”) is now also subject to the inspection and supervision of the Superintendency of Finance as a result of Law 1870 of 2017, also known as Law of Financial Conglomerates, which came in effect on February 6, 2019. Grupo Aval, as the holding company of its financial conglomerate is responsible for the compliance with capital adequacy requirements, corporate governance standards, risk management and internal control and criteria for identifying, managing and revealing conflicts of interest, applicable to its financial conglomerate.

Our subsidiary banks, Banco de Bogotá, Banco de Occidente, Banco Popular, Banco AV Villas and their respective financial institutions, including Porvenir and Corficolombiana, are subject to supervision, inspection and oversight by the Colombian Financial Superintendency.

As an issuer, Grupo Aval must comply with periodic duties of reporting financial information and Corporate Governance policies. As a registered company in the American Securities and Exchange Commission (SEC) and as an issuer of securities listed in the New York Stock Exchange (NYSE), Grupo Aval must submit on annual basis a 20-F form before the SEC and provide relevant information of the company on a 6-K form as required by applicable regulation.

As of December 31, 2024, Grupo Aval had over 70,000 stockholders. The company has had five stock democratization processes (1999, 2007, 2011, 2013 and 2014). As of December 31, 2024, there were 23,743,475,754 outstanding shares.

Grupo Aval common and preferred shares are listed in the Colombia Stock Exchange and the preferred, in the form of ADRs, in the New York Stock Exchange (NYSE), its tickers in the Colombia Stock Exchange are GRUPOAVAL and PFAVAL, respectively and in in the New York Stock Exchange its ticker is AVAL.

Ordinary (common) shares benefit from the company's fiscal year profit and have the right to vote in the General Stockholders' Meeting. Preferred shares do not have the right to vote in the meeting, but have the right to receive a minimum dividend over the fiscal year profit provided that is higher than the dividend declared for common shares. Otherwise, the dividend received will be the same as the dividend declared for ordinary (common) shares.

At this time Grupo Aval’s international bond offerings have the following ratings:

| Rating agency | Rating / Outlook | Last update |

|---|---|---|

| Fitch Ratings | BB+ / Negative | 13/03/2025 |

| Moody’s | Ba2 / Stable | 16/07/2025 |

As of December 2024, Grupo Aval consolidated had over 70,000 employees- The breakdown by entity is described in the table below:

| Banco de Bogotá | 14,671 |

| Banco de Occidente | 16,800 |

| Banco Popular | 5,680 |

| Banco AV Villas | 6,297 |

| Porvenir | 2,464 |

| Corficolombiana | 22,684 |

| Grupo Aval Acciones y Valores (Holding) | 124 |

| Aval Fiduciaria | 438 |

| Aval Casa de Bolsa | 152 |

| Multibank (Centroamérica) | 961 |

| Grupo Aval Consolidado | 70,271 |

In 1998, Grupo Aval's subsidiaries (Banco de Bogotá, Banco de Occidente, Banco AV Villas and Banco Popular) made up the Aval Network of Services. Customers of any of the banks in the group can make transactions, payments and transfers through the network of any of the other banks in the group (over 990 offices, more than 2,800 ATMs and more than 120.000 others points of service in Colombia as of December 31, 2024).

- When are Grupo Aval´s dividens paid?

- What is the ex dividend period and when does it operate?

- What are Exdividend dates?

- Where can I get my dividends?

- Conversion of Common Shares to Preferred Shares

- Are there tag-along rights for Grupo Aval shares?

- Who can I request a share certificate from?

- How and where can I buy or sell ordinary or preferred shares of Grupo Aval in Colombia?

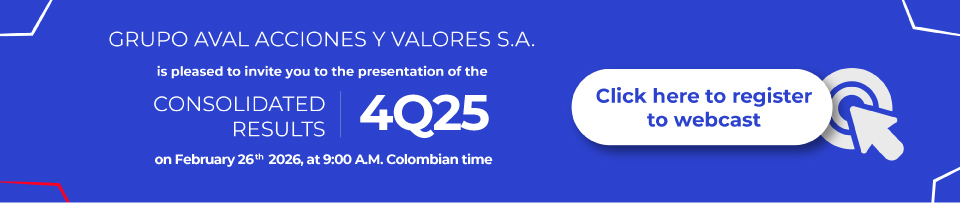

- How and when can I obtain Grupo Aval results?

- How can I get in touch with the Investor Relations area?

Grupo Aval’s dividends are approved at its General Shareholders' Assembly and are declared on the basis of separated net income for the immediately previous accounting period (semester or year). Historically, Grupo Aval´s has also paid a stock dividend, subject to the rules and limitations set forth under Colombian law, their form and date of payment will be approved by the General Shareholders' Assembly.

The ex-dividend period or date refers to the time during which it is understood that a transaction of sale of shares does not include the right to receive dividends pending payment by the buyer provided that such operations are held in the period determined in the numeral 4 of article 3.1.1.12 of the Regulations of the Colombian Stock Exchange (BVC).

| Exdividend dates - April 2022 to March 2023(*) | ||

| Month | Initial Payment Date (dd.mm.yy) |

Final Payment Date (dd.mm.yy) |

|---|---|---|

| May, 2022 | 24.05.2022 | 31.05.2022 |

* Ex-Dividend period pursuant to Colombian applicable regulation. Ex-Dividend dates may vary subject to any determination of the Colombian Stock Exchange with respect to the business days for trading purposes

In most part of our network of offices of our banks, to know in detail the authorized entities you can contact Deceval in the following numbers: 3077127 in Bogota or 018000111901.

The conversion of common shares to preferred Grupo Aval shares is governed by the authorization granted for the purpose by the Extraordinary General Stockholders' Meeting, in the minutes, of December 7, 2010 and by Grupo Aval's Corporate Bylaws.

Only the number of common shares requested by the stockholder on the form will be converted to preferred shares, which must be available at the time of conversion. The relationship of Grupo Aval Common Shares to Preferred Shares conversion is one to one. In other words, for each common share to be converted, one preferred share will be issued.

Every Conversion Request must be presented in the Form, which can be downloaded from Grupo Aval's website (www.grupoaval.com), together with the instructions, I1-P-GA-SA-04 to Complete Conversion of Common Shares to Preferred Shares, and instructions 12-P-GA-SA-04 to Process Request of Conversion of Common Shares to Preferred Shares.

The stockholder must complete all the fields in the Form and attach all the necessary documents, as applicable, in accordance with the Instruction form. Any Form that has incomplete information or annexes, or has crossed-out information or corrections shall be returned to the mailing address indicated by the stockholder in the same Form, along with the copies and annexes received to be corrected or completed.

Share conversion requests are processed only once a month in accordance with the clarifications included in the Form.

The form may be downloaded from the following link:

No. However, Colombian legislation demands that when an investor decides to buy more than 25% of a company listed on the stock exchange, the acquisition must be made through a Takeover Bid, or OPA (Spanish acronym), in which the purchase price will be the same for all acceptors of the bid.

When an investor has more than 25% of a company listed on the stock exchange and decides to increase his/her share by more than an additional 5%, it must make an OPA

Common and preferred shares certificate request process in Colombia:

This procedure is made directly in Deceval's Stockholder Service Office located in Carrera 7 No. 71-21, Tower B, 12th Floor in the city of Bogotá D.C., where stockholders receive personalized service, or by calling the stockholder service lines at 307-7127 in Bogotá, or 018000-111-901 outside Bogotá. Deceval, or the Centralized Securities Deposit, is the entity that acts as custodian and administrator of Grupo Aval shares.

ADR Shareholder Certificate Request Process (for registered shareholders only with an account at J.P. Morgan, the depositary bank):

To request a certificate, you may send a letter of instruction by mail or fax to +1 (651) 450-4085. Be sure to include the account number or social security number, the registration on the account, address, company of stock, the number of shares you would like issued into a certificate, and the signature of a registered shareholder. You may also contact our service center from outside the US at +1 (651) 453-2128 or toll free at (800) 428-4237. Requests to issue specific tax lots dated after January 1, 2011 must come in writing. The Letter of Instruction must include: Number of share and Acquisition price of each tax lot. If this is not available, we will accept the purchase price and Acquisition date of each tax lot or the effective date. The effective date should be noted in the letter.

The request may be sent by mail to:

Shareholder Communications

1110 Centre Pointe Curve Suite 101

Mendota Heights MN 55120

Restricted accounts: Requests will be processed provided there are no restrictions on the account which may delay or prevent the transaction from occurring.

Note: Beneficial shareholders should contact their bank or broker to request the certificate.

The purchase and sale of shares in the secondary market in Colombia is done through Broker Dealers. A complete list of the authorized broker dealers in the country can be found at the website of the Colombian Stock Exchange (Bolsa de Valores de Colombia). It is necessary for the investor to contact the broker dealer of his/her preference to understand the process required to finalize the intended transaction and to receive information about any potential costs associated with it.

At the following email address:investorrelations@grupoaval.com

Contact information for Grupo Aval's Investor Relations area are:

Nicolás Noreña Trujillo

Senior Financial Planning and IR Manager

Tel : ( 601) 7433222 Ext :23350

E-mail: nnorena@grupoaval.com